The original intended purpose of derivatives when it was apparently first introduced around 1800s was to manage risk. But it has since evolved into a speculation tool that has ironically increased the risk in the system akin to tail wagging the dog. History is replete with instances of financial crises getting accentuated by the excessive use of hedging tools as the main trading strategy, such as the Black Monday, the October 1987 US crash or the 2007 global market meltdown.

To this extent while globally speculation has been at previously unseen levels post-Covid, SEBI’s measures including the recent actions against Jane Street are much welcome.

In a market where there is no dearth of volatility, the ratio of Futures & Options (F&O)-to-cash turnover has now fallen to its lowest levels in three years (BSE and NSE combined). This can be attributed to SEBI measures implemented since last year. This can be viewed as a positive, although at 285 times, the ratio implies speculation remains rampant at least on a relative basis when compared to pre-Covid levels.

Trading frenzy

During the boom years of 2021-2023, this ratio surged, driven by a retail trading frenzy. However, in aggregate retail traders have had a torrid time losing out to institutions, especially FIIs, as indicated by data published by SEBI in the last two years.

Whether some of these profits were within the rules is now in question in the light of SEBI’s recent ban on Jane Street for alleged market manipulation. The bigger question is what is driving this retail frenzy?

Is it inadequate understanding that naked F&O trading is a zero-sum game, which involves wealth transfer rather than wealth creation? Or is it an addiction that is hard to kick?

What ever the reason, it is clear that systemic measures are required to curb reckless speculation, akin to the Nudge theory propounded by Nobel laureate Richard Thaler.

Silver lining

The F&O-to-cash-trading volume, at 285 times in June is well below the peak of 487 times in October 2023. While it has continued to remain volatile since, the trend clearly appears to be down. This marks a significant shift, one largely influenced by SEBI’s regulatory measures to clamp down on excessive trading volumes and speculative activity.

Measures like the reduction in weekly options and the increase in contract values for index derivatives, introduced in late 2024, are showing their impact. This has led to a 36 per cent drop in cumulative F&O turnover (including NSE and BSE) from the time the measures were introduced in November 2024 to June 2025, as tighter conditions force traders to adjust.

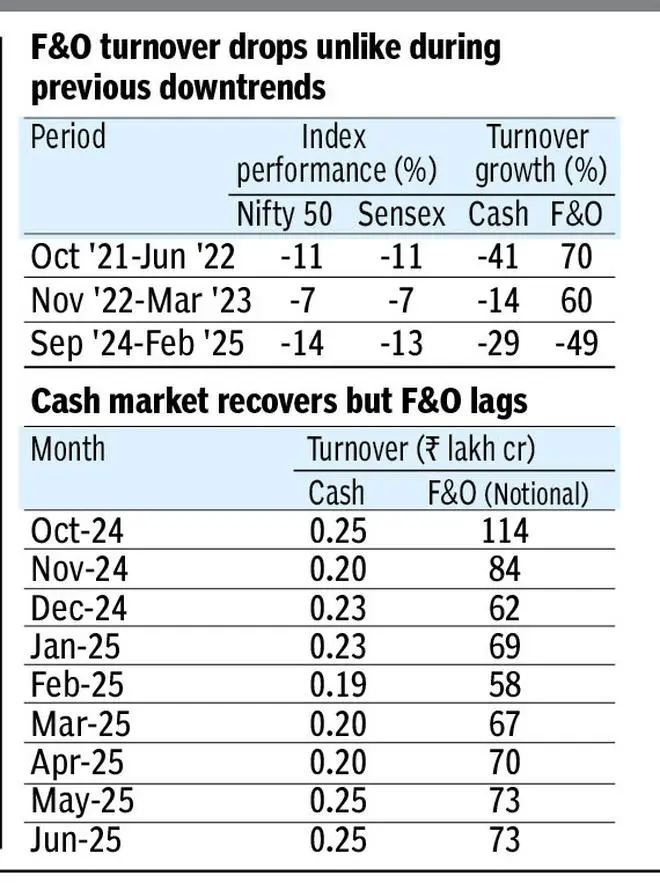

Comparing the last three downtrends, there is evidence that the SEBI measures has discouraged F&O activity to a notable extent. During the October 2021-June 2022 and November 2022-March 2023 downcycles, the equity turnover decreased (refer table) but the derivatives turnover saw a significant increase as F&O contracts allow participants to monetise during a bear market, too.

However, during the latest downtrend, between September 2024 and February 2025, the turnover in the F&O segment, too, dropped.

As the market has been on a recovery over the last four months, there has been an increase in turnover in both the segments. However, while the equity turnover in June returned to levels seen in October last year, the F&O turnover has increased marginally.

Going ahead, it is highly likely that cash market growth will be higher than that of the derivatives segment as measures like higher lot size, more margin requirements and availability of weekly options only on one index per exchange will limit participation.

Against the grain

Though the cumulative turnover in F&O has reduced in the first half of 2025, volumes in the BSE have seen an uptick.

In H1 of calendar 2025, BSE’s turnover increased by 45 per cent to ₹150-lakh crore compared to the same period last year. But NSE’s turnover dipped 44 per cent to ₹259-lakh crore during the period under consideration. Consequently, BSE’s share in the derivatives segment improved to 37 per cent in H1 compared to 22 per cent in 2024 full year. This is because of the reduction of available weekly options, which is likely to have impacted NSE the most.

Published on July 5, 2025