I’m holding long on following July expiry options: Havells 1600-call bought for ₹44.15 and CONCOR 624-call bought for ₹9.36. I’ve a target of ₹57 and ₹15 respectively. How long should I hold this trade? -Anish Das

Havells India (â‚ą1,527.80):Â The stock saw a decline in price in the recent sessions. But it continues to stay within the range of â‚ą1,500-1,600, within which it has been trading since early May. Therefore, until the stock moves within this price band, the path of the next leg of trend will remain uncertain.

That said, â‚ą1,500-1,515 is a good support and a rebound on the back of this cannot be ruled out. Even though it may not break out of the resistance at â‚ą1,600, there could be a rally towards this level in the near-term.Â

In case the stock appreciates to â‚ą1,600 over the next two weeks, the premium of 1600-call can go up to â‚ą40. Further upside depends on whether the barrier at â‚ą1,600 is breached or not. Also remember that the time value of the option will keep dropping.

Our suggestion would be to exit this trade at â‚ą40. Post this, you can consider buying call again, in August series, once the underlying stock breaks out of â‚ą1,600. Such a move can lift the price to â‚ą1,670 quickly.

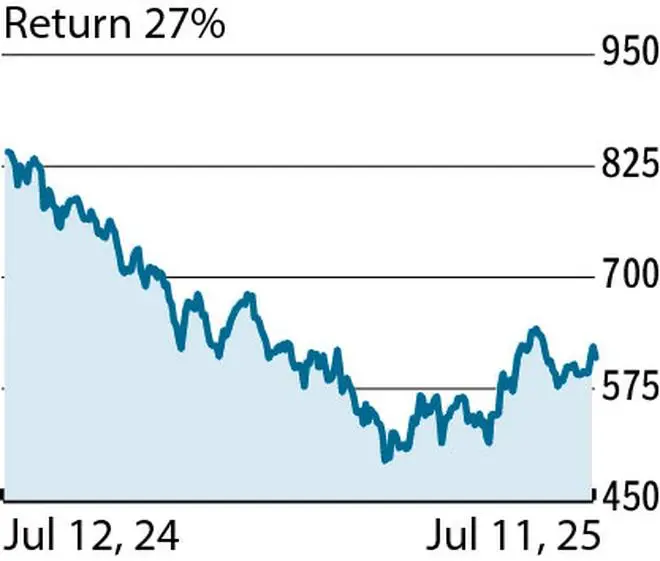

CONCOR (₹614.95): The stock bounced off the 50-day moving average last week and surpassed a barrier at ₹612. Thus, it has formed a higher high in the daily chart.

Although the price dropped on Friday, the prevailing chart set up shows a positive outlook and the stock can rise to â‚ą650 before the end of this expiry.

A rally to â‚ą650 over the next couple of weeks means the price of the 624-call option can rally to â‚ą28-30 level. Therefore, you can retain this trade and look for a target of â‚ą28.

We suggest holding the trades until July 25. If you did not get an exit by that time, liquidate the positions. Do not carry to the final week of expiry where time decay can be faster, potentially eroding the remaining premium quickly.

Send your queries to derivatives@thehindu.co.in

Published on July 12, 2025