We had given an ‘accumulate’ call on the stock of State Bank of India (SBI), almost the same time last year. Since then, SBI has delivered a healthy FY25 with a record profit of ₹71,000-odd crore and best-ever asset quality, at least in the last 25 years. Deposits and advances crossed respective milestones of ₹50 lakh crore and ₹40 lakh crore. With that scale, SBI makes more than one-fifth of the commercial banking system. Its recent performance reminds one of a large Japanese 4×4 vehicle that is well-engineered for heavy duty – consistent, reliable and predictable.

Such performance continued in the bank’s Q1 FY26 results as well. During the quarter, three aspects have been talking points in the banking industry – growth, asset quality and margins. SBI has fared and is also set to fare well on all three counts – in line with the industry, if not better.

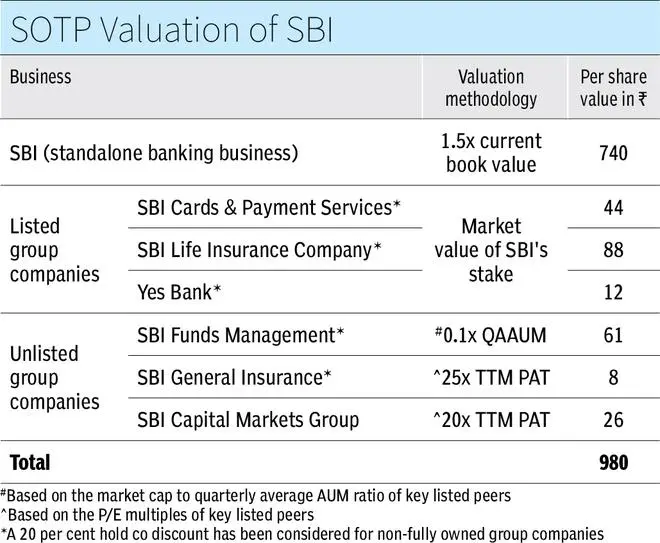

Ever since our last call, the stock briefly rallied to ₹875 but has largely remained under our recommended price of ₹816 – giving ample buying opportunities when it dipped to ₹700-odd levels. We now upgrade the call to a ‘buy’, with a revised SOTP (sum-of-the-parts) target price of ₹980 (from about ₹900 earlier), where there is a 22 per cent upside.

However, certain downside risks do remain in the form of a possible slowdown in the economy, triggering a fresh NPA cycle – especially among the vulnerable SMEs and execution risks to a guided margin of 3 per cent. Hence, long-term investors willing to look past these risks can bet on the banking behemoth.

Balance sheet growth

With a slowing economy, credit growth in the system has slowed as well — from the mid-teen to 20 per cent growth (year on year) in FY23-24 to 9.5 per cent in Q1 FY26. SBI managed to post 11.6 per cent growth in both advances and deposits, despite its balance sheet size. Within deposits, CASA grew 8 per cent and term deposits at a quicker 14 per cent (both domestic). On the advances front, retail (36 per cent share) grew 13 per cent, agri (8 per cent share) 13 per cent and SME (12 per cent share) 19 per cent. However, the corporate book (28 per cent share) was a laggard, growing at just 6 per cent – slower than the pace of growth of the overall book, similar to FY25.

The management attributes this to the falling interest rate environment. With rates getting lower, corporates are looking to refinance at cheaper and unfavourable rates for the bank. So, the bank had to let go of some accounts and accept prepayment. Corporates also have preferred lower yields in the money market to bank credit. This explains the slowdown. However, SBI has a large sanction pipeline of ₹7.2 lakh crore yet to be disbursed. This should add to the book’s growth.

Similar to the corporate book, within retail, personal loans (8 per cent share) and auto loans (3 per cent share) have seen lower traction. Though the slowdown in auto loans can be attributed to the sluggish auto market, the bank feels it could’ve done well with personal loans (largely given to salaried public servants). Demand during the festive season should aid an uptick in these segments.

A strong balance sheet

So far, as of Q1, banks with absolutely no concerns on asset quality are few and far between, and SBI is one of them. Headline asset-quality ratios remained steady – the GNPA and NNPA ratios at 1.8 and 0.5 per cent respectively. Slippage ratio (that measures new additions to NPAs as a share of advances) inched up 20 bps though, on a quarter-on-quarter basis, largely because Q1 is seasonally a weak quarter. The ratio at 0.75 per cent is 9 bps lower than that of Q1 FY25. The management expects the ratio to be below 0.6 per cent for FY26.

SBI’s SME loans are either secured or backed by the CGTMSE (Credit Guarantee Fund Trust for Micro and Small Enterprises) guarantee. GNPA ratio rose 14 bps to 1.21 per cent in the personal loans. However, this is due to the anaemic growth in the loan base (year-on-year growth of 0.5 per cent in FY25 and 0.34 per cent in Q1 FY26).

Further, the bank holds non-NPA provision buffers of ₹30,345 crore, amounting to 0.7 per cent of gross advances. The bank’s CRAR also was boosted by the recent ₹25,000-crore QIP, taking it up to 15.9 per cent. Overall, the balance sheet appears strong.

Margin outlook

With 100 bps of repo cuts in place, SBI’s domestic NIM (domestic loans are 85 per cent of the loan book) contracted 13 bps to 3.02 per cent. Though there could be further contraction in Q2, the management has guided for NIM (domestic) to be maintained at 3 per cent for FY26, as a large part of the term deposit book is set to reprice in Q3 and Q4. The CRR cut and its favourable impact on cost of funds, too can aid margin. RoA has been guided at 1 per cent.

How subsidiaries fared

The bank’s group entities continue to post decent performance. These account for 24 per cent of our SOTP price. Particularly, the life insurance and mutual fund arms posted healthy profit growth of 14 per cent and 24 per cent respectively, in Q1 FY26. General insurance business delivered a flat profit growth, while SBI Cards’ profit declined 6.4 per cent as it continues to grapple with weak asset quality. SBI Cards’ CRAR is adequate at 23.2 per cent.

Published on August 9, 2025