Cost of materials consumed during the period witnessed a 15.31 per cent y-o-y increase at ₹6,171.10 crore.

| Photo Credit:

REUTERS

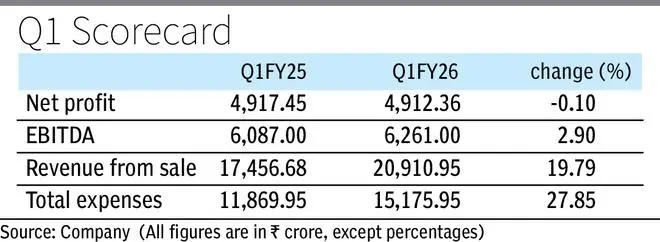

ITC Ltd on Friday posted a marginal year-on-year (y-o-y) decline in its standalone net profit in the first quarter (Q1) of this fiscal at ₹4,912.36 crore, as profitability of its non-cigarette FMCG business, and paperboards and paper business came under pressure during the period.

The Kolkata-headquartered conglomerate had posted a net profit of ₹4,917.45 crore in Q1 of FY25.

During the period under review, the company’s revenue from continuing operations grew close to 20 per cent y-o-y at ₹20,910.95 crore from ₹17,456.68 crore in the year-ago period, on the back of growth in cigarette and agri businesses.

Notably, the conglomerate’s hotel business was demerged into ITC Hotels Ltd with effect from January 1, 2025. The equity shares of the hospitality major were listed on the NSE and BSE on January 29.

The conglomerate stated that considering the discontinuing business (Hotels), the net profit was up by 1.9 per cent y-o-y for the first quarter of FY26.

On Thursday, ITC Ltd, in a statement, said it registered a “resilient performance” amidst a challenging operating environment.

Expenses rise

During Q1 FY26, the cigarette-to-soap maker’s total expenses rose close to 28 per cent y-o-y at ₹15,175.95 crore from ₹11,869.95 crore in Q1 FY25. Cost of materials consumed during the period witnessed a 15.31 per cent y-o-y increase at ₹6,171.10 crore.

Its EBITDA grew 2.9 per cent y-o-y at ₹6,261 crore, compared to ₹6,087 crore in the year-ago period. Excluding the paper business, the EBITDA was up by 5 per cent y-o-y.

Revenue from the company’s cigarette business rose 7.6 per cent y-o-y to ₹8,520.04 crore in Q1, while operating profit from the segment increased by 3.74 per cent y-o-y to ₹5,145.28 crore during the period, according to the stock exchange filing.

During the quarter under review, its non-cigarette FMCG business registered a 5.21 per cent y-o-y growth in its revenue to ₹5,777.01 crore, while the segment posted a 16.47 per cent y-o-y decline in operating profit at ₹397.49 crore during this period. “Commodity prices remain elevated y-o-y (edible oil, wheat, maida, cocoa, soap noodles etc.),” the company said in the statement.

“Notebooks industry continues to operate under deflationary conditions on account of low-priced paper imports and opportunistic play by local/regional players; Unseasonal rains during the quarter impact Beverages sales. Staples, Biscuits, Dairy, Premium Personal Wash, Homecare and Agarbattis drive growth,” it said, adding, excluding Notebooks, the non-cigarette FMCG business revenue was up 8.6 per cent y-o-y during the period.

The segment’s EBITDA margins stood at 9.4 per cent as against 11.3 per cent in Q1FY25.

Agri buisness

In Q1 FY26, the company’s agri business witnessed a 38.89 per cent y-o-y growth in its revenue to ₹9,685.03 crore, whereas the segment posted a 21.96 per cent y-o-y rise in its operating profit to ₹433.88 crore. “Agile execution of trading opportunities leveraging multi-channel and digitally powered agri commodity sourcing network,” per the statement.

Paperboards, Paper & Packaging business of the conglomerate witnessed a 7.04 per cent y-o-y growth in its revenue at ₹2,115.76 crore during the first quarter this fiscal. However, the business posted a 37.77 per cent fall in its operating profit at ₹162.62 crore during the period.

“Muted realisations and high wood prices continue to weigh on margins. Strategic interventions continue to be made towards enhancing plantations, sharper product portfolio and thrust on structural cost management,” the statement added.

Published on August 1, 2025